Houston – Spring, TX 77386 – Subject-to. $35k Below Market Value. Cashflow $745/mo After Expenses

Property Details

Year Built: 2011

Square Footage: 1,855

Bedroom Count: 3

Bathroom Count: 2

Garage: 2G

Pool: No Pool

Solar: No

HOA: $46/mo

Acquisition Details

Estimated Retail Value: $295,000

Purchase Price: $253,952

Seller Buyback Option: None

Lease Details

Lease Term: 24 months

Monthly Rent: $2,200

Tenant Monthly Payment: $1,700

Prepaid Rents: $12,000

Subject To Details

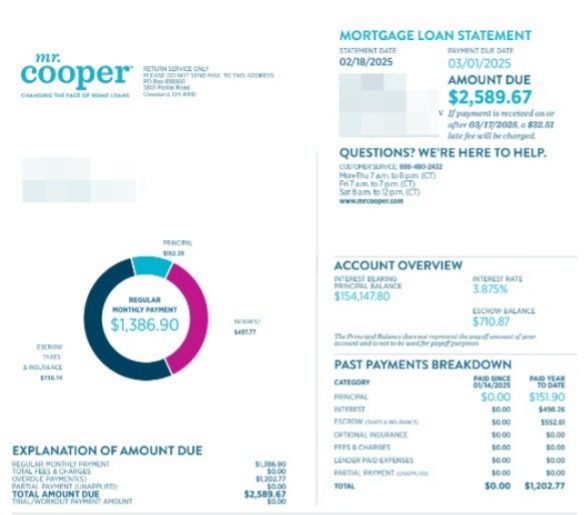

Mortgage Principal Balance: $154,147.80

Interest Rate: 3.875%

Monthly PITI: $1,203

Equity Needed To Purchase: $111,620

Includes: down-payment, some closing costs, and estimated repairs of approx $7000

| Property Specifications | 1 |

| Bedrooms | 3 |

| Bathrooms | 2 |

| Square Feet | 1855 |

| Year Built | 2011 |

| Garage Size | 2 |

| Schools Rating (scale 3-30, 30 is best) | 22 |

| Lot size (sq ft) | 5,897 |

| Purchase Assumptions | My Offer |

| Offer used for analysis | $253,952 |

| Suggested offer (low) | $255,000 |

| Suggested offer (high) | $255,000 |

| Asking | $253,952 |

| Market Value (after improvements) | $290,000 |

| Day-1 Equity | $36,048 |

| Estimated Improvements (lower) | $6,500 |

| Estimated Improvements (upper) | $7,500 |

| Estimated Closing Costs | $2,540 |

| Estimated Mortgage Costs | $0 |

| Other Fees At Closing (pts, . . . ) | $500 |

| Total Cost (estimated) | $263,992 |

| Financing Assumptions | |||

| Down Payment (%) | 40% | ||

| Down Payment Amount | $101,581 | ||

| Financed Amount | $152,371 | ||

| Interest Rate | 3.875% | ||

| Mortgage Term (Years) | 30 | ||

| Monthly Mortgage Payment | 32.6% | $717 | |

| Cash Outlay (Total Out of Pocket) | $111,620 | ||

| Estimated Financial Assumptions | Monthly | Yearly | |

| Rent (upper)* | $2,200 | $2,200 | $26,400 |

| Rent (lower)* | $2,200 | $26,400 | |

| * Can fluctuate depending on time of year property is being rented. | |||

| Property Taxes | $300 | $3,600 | |

| Insurance | $150 | $1,800 | |

| Repairs | 75 | $80 | $960 |

| Property Management Monthly (%) | 0.0% | ||

| Property Management Monthly ($) | $85 | $1,020 | |

| Leasing Fee | 100% | $91.7 | $1,100 |

| HOA or Fixed Costs | $46 | $552 | |

| Vacancy Rate | 4.0% | ||

| Total Fixed Expenses | 38.1% | $837 | $10,047 |

| Total Expenses (Fixed + Mortgage) | $1,554 | $18,645 | |

| |||||

| Years: | 5 | 10 | |||

| Cap Rate | 8.0% | 9.5% | |||

| Net Cash Flow | $44,671 | $105,605 | |||

| Equity Increase | $94,957 | $215,217 | |||

| Total Gain | $139,628 | $320,822 | |||

| Average Cash Flow/Year | $8,934 | $10,561 | |||

| Average Cash Flow/Month | $745 | $880 | |||

| Average Gain/Year | $27,926 | $32,082 | |||

| Average ROI | 125.1% | 287.4% | |||

| Annual ROI | 25.0% | 28.7% | |||

| Projected Property Value | $370,122 | $472,379 | |||

![]()

Disclaimer

The information provided herein has been compiled from sources believed to be reliable; however, no representation, warranty, or guarantee, express or implied, is made as to the accuracy, completeness, or suitability of this information. All property details, pricing, and projections are subject to change without notice, and may include errors, omissions, or withdrawal from the market at any time.

The analysis and projections are offered “as is” for illustrative purposes only and should not be relied upon as investment, legal, tax, or financial advice. It is the responsibility of each individual to independently verify all assumptions, data, and projections.

By reviewing this information, you agree to release all parties involved in the preparation and sharing of this material from any and all liability related to its use or interpretation.